The famous quote, “Oh, what a tangled web we weave when we practice to deceive” often attributed to Shakespeare, was written by Sir Walter Scott. The expression found in his 1806 literary work, Marmion: A Tale of Flodden Field, centers on the love story of two English nobles Clara and De Wilton, and Marmion, who planned to destroy their love to acquire their land.

This epic poem is about the Battle of Flodden Field (1513), a conflict between the Kingdom of England and the Kingdom of Scotland. It was an English victory and the largest battle ever fought between the two kingdoms. At the conclusion of the poem, Marmion dies on the battlefield, while De Wilton displays heroism, regains his honor, retrieves his lands, and marries Clara.

The above chart displays the ongoing twisted and tangled effects of an epic battle that is in a league of its own, the age-old battle between statist central bankers, Wall Street, politician’s, and the ruling class vs. the global proletariat.

Interwoven on this chart are the data points for five markets, which span from 1995 to present. Listed on the right axis are today’s prices for each market. From the highest nominal value to the lowest, the chart displays:

The global working-class hopes that in the end, like De Wilton and Clara, they too shall display heroism, regain their honor, retrieve their freedom, and retain for themselves the fruits of their hard-earned labor.

Despite the blatant failures and attendant frailty of the Marmion-like ruling class, a working-class victory is a long way off as statists continue to weave and impose their cunning dictates without shame, while the spellbound proletariat remains mostly dazzled or stunned by bread and circus.

Example via Kyle Bass: Keynesian Endgame Eventuality I.E. Japanese Central Bank

The Marmion-like ruling class yields most of its power through its monopoly to create money-as-debt out of thin air, and finds itself stuck between a rock and hard place as a result. Such is the web they insist upon weaving.

Either they somehow manage to orchestrate/impose another 20-years of suppressing truth as would otherwise be expressed in a free-market gold price, or they keep doubling down toward creating the horror of a global fiat currency that will permanently enslave the entire world.

One view suggests that the kingpin US central planners must keep their world-reserve fiat trading in a tightly controlled band between 83.00 on the top-end and 75.00 on the low-end. Sustained un-orderly trade above 83.00 $USD may spawn a deflationary spiral, while sustained un-orderly trade beneath 75.00 $USD may incite a hyperinflationary insolvency event, and they must keep to this tight band while maintaining control of ZIRP, the infamously ridiculous save-our-monopoly-at-all-cost zero-interest-rate policy.

Silver Update

We will introduce the latest update on the price of Silver with a re-stylized rendition of the infamous quote from the above referenced Marmion, A Tale of Flodden Field:

“Ron Paul’s sharp questions they must shun;

They struggle for truth, but there is none-

O what a tangled web they weave,

When first they practice to deceive!-

So bold-faced too! - no wonder why

They deserve rebuke beneath this lie.”-

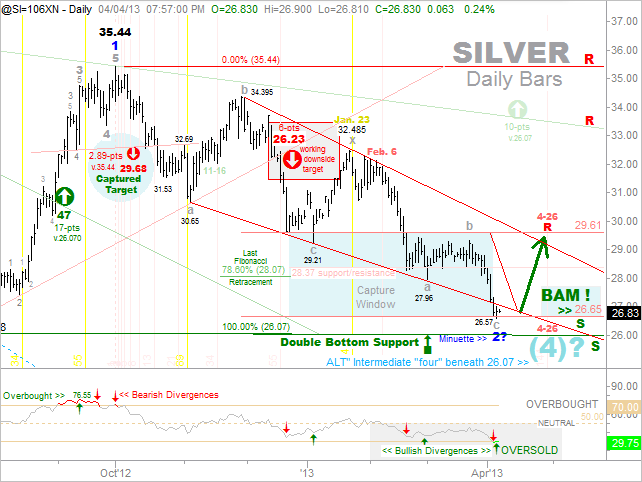

Since the last Hedge All Bets update, there is no material change. Most notable of late was the recent tag of 26.65, which was a long-standing downside price target residing at the bottom of the capture window noted. Despite the print low at 26.57, there is one more downside target remaining for capture at 26.23.

Silver is deeply oversold and for now, sports a subtle bullish divergence vs. the 26.57 print low. Silver is rapidly nearing a double bottom support level at 26.07, a breach of which would shift this wave count to the ALT intermediate (4) wave illustrated.

Bear in mind, (pun intended), it ain’t over till it’s over. Until then, the artificially suppressed price levels of both gold and silver continue to offer physical buyers ample low-risk opportunities to continue accumulating metals to hedge the preservation of their wealth from the Marmion Dream Weavers.