For the month of March, the benchmark S&P 500 put in another decent performance, up another 2.11% for the month, which puts it at a 12.59% return year-to-date.

This is a phenomenal quarterly return considering that the average yearly return for the past ten years has been just 4.12%.

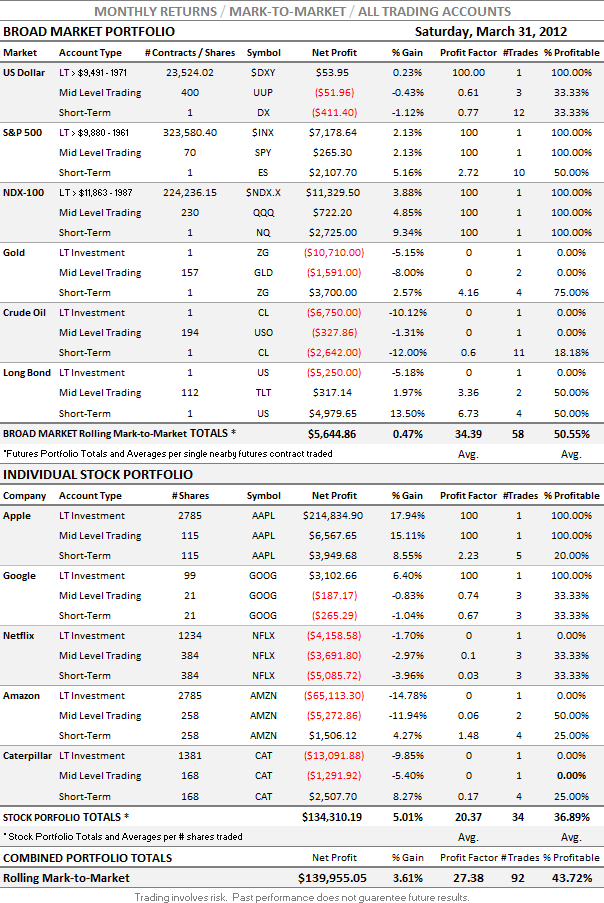

This month, Elliott Wave Technology’s Chart Cast Pilot portfolios beat the S&P 500 returning 3.61% vs. the benchmarks 2.11% return.

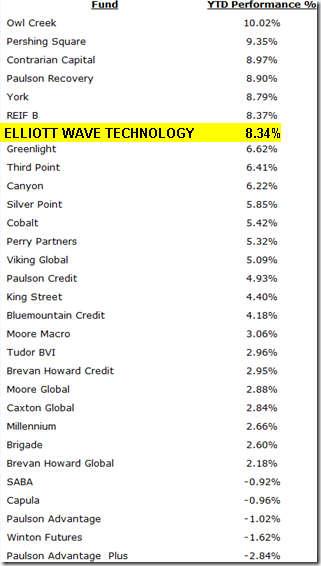

Top 30 Best In Breed Hedge Funds YTD Performance

In fact, when compared against 29 “best in breed” hedge funds, which typically charge 2% of investment capital and 20% of profits, Elliott Wave Technology’s Chart Cast Pilot ranks # 7 out of 30 of these best in breed funds with a year to date performance of 8.34%.

In sharp contrast to the customary 2% and 20% fees charged by hedge funds, the Chart Cast Pilot charges 0% on capital and 0% on profits, we simply charge a monthly subscription fee of $59, which translates to just over $700 per year.

That’s less than 1% annually on a portfolio size of 100K, which is an outstanding value considering that most best in breed hedge funds require at least 500K simply to open an account.

The stats below breakdown this month’s mark-to-market result for all trading accounts broken down by market, timeframe, and tradable.

To learn more about some of the nuances related to mark-to-market reporting, read the paragraph titled “The Realities and Deceptions of Mark-to-Market Reporting,” which begins beneath the stats presented for February 2012.

Elliott Wave Technology’s CHART CAST PILOT portfolios