Well, if you look at our short-term mark-to-market performance for the month of February, you would at first glance conclude that from its perspective, Gold was not very sexy at all.

However, if you take a minute to read about one of the deceptive nuances of mark-to-market reporting, you will soon come to realize, that with respect to short-term trade in Gold futures, February was indeed a rather sexy month here at Elliott Wave Technology.

This feature provides a more concise follow-up and visual account of exactly how things panned out for us. In fact, the Gold market in February was…

...SEXY as ALL HELL !

We have split the following five charts between two genres to chronicle precisely just how sexy and titillating the short-term Gold market was in February.Before we get into more eye candy (of the charting kind that is), let’s warm up by getting better acquainted with the methods used to court the market in this regard.

The first of the two methods of engagement involves the identification of chart patterns that yield specific point values within their construct. Let’s take a look at these first.

Chart Pattern Trade-Triggers …(Let’s Get VISUAL)

We identify these patterns quite simply with a trajectory or trendline, which we then refer to as trade triggers. Naturally, each trade trigger harbors a directional bias; it is either bullish or bearish

Typically, we use buy-stops to move long and sell-stops to go short in order to speculate on these types of chart-pattern trade-triggers. As you will see in the charts that follow, the entire process from pattern to trigger to price-target is totally a visual experience.

In addition to identifying the trigger lines in advance, we also identify a specific price, pivot point, or stop-loss level at which the trade would technically fail. This allows us to measure the full risk associated with each particular setup before deciding whether to take the trade or not.

Furthermore, each trigger-line drawn has a specific upside or downside point value associated with it. These point values provide us with a precise profit and exit target, which upon achievement, we capture via the placement of resting limit orders to exit, which we set just moments after our initial entry orders fill.

Insofar as we are concerned, Chart Pattern Trade-Triggers come under the classification of “Charting and Forecasting.” As such, we feature them regularly in the Near Term Outlook and Position Traders Perspective, which you can learn more about here, and yes, we use these triggers successfully in all timeframes.

With that said, now we can move on to that eye candy (within the genre of charting and forecasting) that we alluded to earlier.

The February Gold Chronicles:

We begin our journey back on January 9, 2012, with an extract from our Near Term Outlook publication.

Within the archived image posted below, the first paragraph of commentary prefixed “ABOVE,” describes a full-size longer-term chart that resides at the top half of its page, which we removed in order to draw your attention to comments prefixed “LEFT,” which describe the advance setup of our first chart pattern trade trigger.

In the last line of the second paragraph, we stated, “Though a pullback toward 1563 is plausible, so long as the 1522.60 low holds, we cite a 113-point buy trigger on a breakout above the falling green trendline.”

Looking at the 30-minute Bar chart of Gold below, you can visually see a falling green trendline with a green up-arrow with a 113-pts. reference tag associated with it.

Upon closer visual inspection, it was rather clear to observe that this prospective buy trigger (basis nearby Gold futures) would elect upon a move north of 1630 or so. As such, we set buy stops to move long at 1630 with sell initial sell stops to cover beneath 1522.50, which risked 107-pts, giving us a little better than even odds in our attempt to capture this triggers 113-pts of upside.

In addition, if our resting buy-stop order filled, we would immediately set limit orders to sell 113-pts north of the trigger-point or in this case at an exit price of $1742 dollars an ounce.

On the next day, January 10, 2012, Gold broke out above the trade trigger and our buy stops elected at 1630.

The next chart below illustrates an extremely sexy and profitable outcome, which resolved on February 1, 2012 when our limit orders to exit at target filled at 1742, delivering 113-pts or $11,300 dollars in profits per contract traded. As the late Steve Jobs often said, “But wait, there’s more.”

About a week later on Wednesday February 8, 2012, we spotted another buy-trigger. This one cited 42-pts of upside and looked as though it would trigger from around the 1746 handle.

So we once again placed buy stops to move long at 1746 with sell stops to cover at 1705, which would give us about even odds at grabbing an upside target at 1788.

The next day on February 9, 2012 our buy stops elected in what appeared to be a false head fake breakout to the upside. Knowing and accepting our predefined risk parameters, we held steady with our initial stop loss, and further maintained resting limit orders to exit throughout the trade win, lose, or draw.

After enduring a week of painful drawdowns in excess of -$4,000 dollars at the 1705.50 trough, we thought for sure we would stop out, so we fully prepared to write the trade off as a loser.

To our delight, 1705.50 held pivot low and from there, as if on command to suit our limit orders to exit with 42-pts or $4,200 in profit, on February 28, 2012 Gold delivered us our 1788 exit upon printing a pivot high of 1789. Moments later, the price of Gold collapsed nearly $100 sinking more than 5 ½ % in a matter of hours.

Next, in our last two charts, we will move on to the second genre of engagement, which is much more mechanical but just as sexy.

ZERO-to-SEXY

We have extracted the last two charts below from our Chart-Cast Pilot publication, which embraces automated algorithmic buy and sell signals that we have coded to capture Elliott Waves within three basic timeframes.

Since Elliott Waves represent the development and structure of trends spanning nine fractal degrees, by its very nature and at its core, Elliott Wave Theory is the embodiment of trend following.

Rather than all nine degrees of trend, we have simplified our trading strategies to capture Elliott Waves in three basic timeframes, long-term, mid-level, and short-term.

Each of our three strategies is always in the market, and as with any trend following strategy, our entry and exit points will rarely, if ever reverse near absolute highs or lows, and instead, attempt to catch the meaty middle of a move, and allow profits to run.

Furthermore, the strategies do not use stops per se, instead the each strategy employs a protective “stop and reverse” feature rather than a predefined stop-loss exit level.

Rocket Man

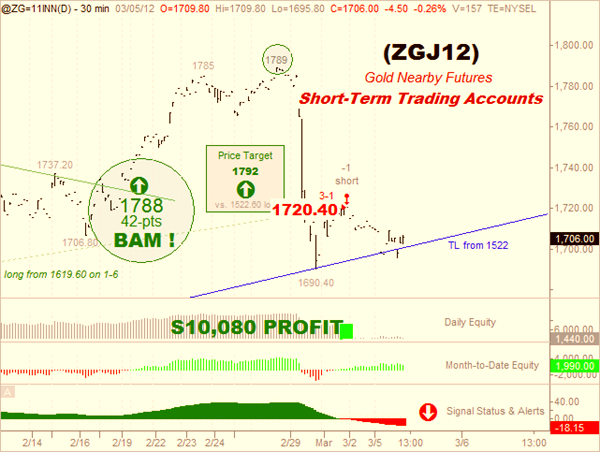

Below, we draw your attention to our short-term trading strategy in the Gold futures market.

Note that we did not take profits on shorts at or near the 1522.60 low, nor did we get long there. Instead, we awaited confirmation of a suitable change in trend dynamics from which to reverse our position bias with the highest possible odds of sustainable long-term success.

As the old saying goes, “do not shoot (or pull the trigger) until you can see the white’s of their eyes,” and each of our trading strategies are programmed to do just that.

Finally, we will wrap it all up in this last chart, which illustrates how this programmed trade resolved.

As an aside, you can clearly see by the now familiar 1788 price target capture (circled), that we do provide and overlay ancillary trade triggers on our strategy charts.

We do this for several reasons. One reason is for those who wish to take ancillary side-bets outside the purview of the trading strategy, and another reason is for those who may at their discretion, wish to exit early and get flat at a specific target price rather than wait for a reversing signal confirmation, which is guaranteed to drawdown peak open trade equity.

So here, the key distinction in the resolution to this programmed trade is where it booked profits and reversed short. As you can see, the trade held long throughout the triple digit plunge to 1690, and did not take its $10,080 dollars per contract in profit until March 1, 2012 at a price of 1720.40.

All told and in stark contrast to what our monthly mark-to-market reporting may have implied, the three trades depicted herein netted more than $25,000 dollars per contract in trade profits in short-term trading accounts for the very sexy month of February 2012.

Until Next Time,

Trade Better / Invest Smarter